Which Structure Is Best for My Business, Part 2

By Beth Borrego / Published February 2015

Editor’s Note: Part I of this series dealing with Sole Proprietorships and LLCs ran in the December 2014 issue. To read the article in its entirety, visit http://pubs.royle.com/publication/?i=233671&p=22.

Corporations: Subchapter C and S

Among the variety of structure types available to businesses today is the corporation, which may be classified as a Subchapter of C or S. Just about all of the larger corporations with greater than one hundred shareholders are publicly traded companies, and, for that reason, elect C corporation status. If you plan to grow your company to a very large size, publicly traded or not, structuring it as a C corporation might be the route to go. It’s also popular with those seeking venture capital, or who will be taking on equity investors. However, small businesses too, may elect a structure of Subchapter C, provided that the owners have achieved the age of majority. The majority of the startups out there initially file as either a Corporation Subchapter S, or as an LLC. If they need to make the change later on to a C corporation, the owners can file the appropriate documents to do so.

If the C corporation is of interest to you, you’ll want to explore your state laws regarding them, since they can vary from state to state. A note of caution, if you are thinking of setting up your company in a state other than the state the business is located in, don’t try it. Eventually, you’ll be contacted, and your home state is not likely to be too happy with you. There will also be filing fees associated with any of the structures you select from. While you can do this yourself, it is always best to check with an attorney before attempting to do so. You’ll also need to file a Certificate of Incorporation so that you can get your EIN, which is your Federal Tax ID number. The C and S corporations are also responsible for obtaining any state or local licensing or permits necessary to legally complete the work of the business. Important insurances such as general liability, workman’s compensation, and commercial auto should also be acquired and kept up to date. It’s never okay to operate your business without having them in place.

The Articles of Incorporation are important legal documents and are comparable to the thumbprint of your company in that they are unique and specific to that business alone. Of course, you’ll need to make sure to include the basics like the business name, address, phone number, and website. It’s also important to state the nature of the business, and briefly describe in an overview, what the company does. If you are registering stock, you’ll need to specify the number of shares allocated to each shareholder, the value, and the type of stock. The Bylaws will also need to be written and should include things like the meeting frequency and location for the officers, directors, and shareholders, as well as how many directors there are and their period of service to the corporation. Any compensation for the officers should be noted, and, of course, it can be amended periodically. The business year should be specified as calendar year or fiscal as well. If there are to be stipulations for things like the approval of loans or the signing of contracts, it should also be included. Lastly, don’t forget to include a shareholder agreement outlining what will happen to the Corporation in the unfortunate event that something happens to an owner, such as disability, death, bankruptcy, retirement, or simply wanting out. Planning for these kinds of contingencies up front makes your daily operations run a little more smoothly. There is something to be said for having that peace of mind.

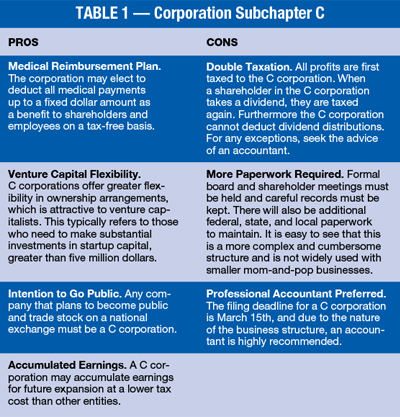

All of the monies paid out to both employees and shareholders as salary, hourly wages, or bonuses, are subject to individual payroll taxes based upon the rate for the specific individual’s income tax bracket. The C corporation’s shares of the payroll taxes are fully deductible by the company. Fringe benefits should be offered to all employees in a non-discriminatory fashion and not just to the shareholders. Check to see which taxes you will be responsible for paying based upon your business. Some of the typical taxes at the state level include sales and use tax and employment tax. Check with your accountant to see which taxes are due and on what schedule, or you could end up paying penalties and interest, along with back taxes. (See Table 1.)

All of the monies paid out to both employees and shareholders as salary, hourly wages, or bonuses, are subject to individual payroll taxes based upon the rate for the specific individual’s income tax bracket. The C corporation’s shares of the payroll taxes are fully deductible by the company. Fringe benefits should be offered to all employees in a non-discriminatory fashion and not just to the shareholders. Check to see which taxes you will be responsible for paying based upon your business. Some of the typical taxes at the state level include sales and use tax and employment tax. Check with your accountant to see which taxes are due and on what schedule, or you could end up paying penalties and interest, along with back taxes. (See Table 1.)

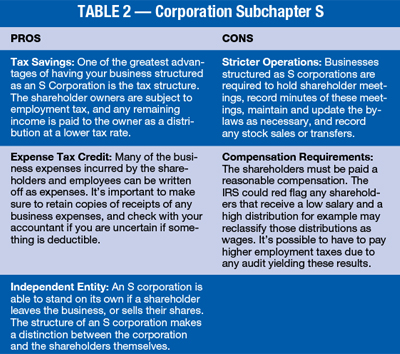

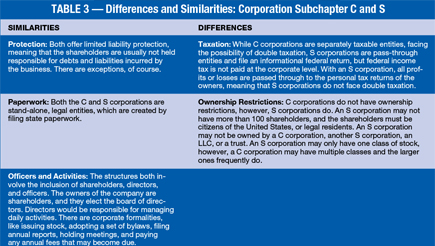

The other structure that a corporation can establish is Subchapter S, or S corporation. While the business structure is more formal and strict than some, it offers nice tax benefits since the owners, or shareholders, avoid double taxation and are subject to employment tax. There are also many tax credit benefits and possible write offs, and the same kind of protections that both LLCs and C corporations offer shareholders and members, is afforded to those S corporation owners as well. For a closer look, see Tables 2 and 3.

The other structure that a corporation can establish is Subchapter S, or S corporation. While the business structure is more formal and strict than some, it offers nice tax benefits since the owners, or shareholders, avoid double taxation and are subject to employment tax. There are also many tax credit benefits and possible write offs, and the same kind of protections that both LLCs and C corporations offer shareholders and members, is afforded to those S corporation owners as well. For a closer look, see Tables 2 and 3.

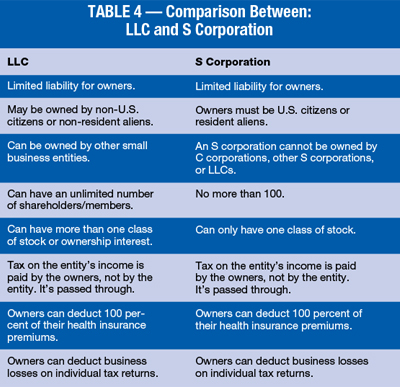

Most small business owners with no intention of growing too big or going public will elect the S corporation given the option between the C and the S. However, when you add the LLC to the mix, you begin to see the similarities, and it comes down to some more specific differences. One of the primary differences between the LLC and the S corporation is that the S corporation represents a very nice tax savings. Shareholders are taxed as employees, at an employment tax rate based upon their income and pass through payroll and distribution earnings. This is different than the LLC in which the members, or owners, are taxed based upon the entire net income of the business.

It’s also important to note that unlike an LLC where the loss of a member can lead to the dissolution of the business, an S corporation will continue with its life as a company. This difference should be carefully considered since it can have a significant impact on the business and its ability to remain viable in the market.

It’s also important to note that unlike an LLC where the loss of a member can lead to the dissolution of the business, an S corporation will continue with its life as a company. This difference should be carefully considered since it can have a significant impact on the business and its ability to remain viable in the market.

Profit sharing is also different when comparing the LLC to an S corporation. The members of the LLC will decide who gets what percentage of any profits, so that if one member is doing significantly less work, they may agree that person gets significantly less profit. This may be beneficial to small business owners whose members perform less actively within the company. With an S corporation, the profit sharing is based upon ownership in the company, regardless of the workload of any individual shareholder. (See Table 4.)

It is easy to see why consulting with a CPA or attorney is strongly recommended when setting up or changing the structure of your business. Doing your homework and making sure you are familiar with both your state and federal tax laws is extremely important. Making a list of what is important for your business and looking at it long term is key when deciding how best to structure it. Understanding the basics of these structures is an important part of launching and maintaining a healthy business.

It is easy to see why consulting with a CPA or attorney is strongly recommended when setting up or changing the structure of your business. Doing your homework and making sure you are familiar with both your state and federal tax laws is extremely important. Making a list of what is important for your business and looking at it long term is key when deciding how best to structure it. Understanding the basics of these structures is an important part of launching and maintaining a healthy business.