Small Business Documents

Protecting and Running Your Business, Part I

By Beth Borrego / Published June 2022

Editor’s Note: This is Part I of a multi-part series discussing the documents needed to run your business. The remainder of this multi-part series will be published in upcoming issues of Cleaner Times.

Perhaps one of the most overwhelming tasks a small business owner faces is the daunting task of making sure that all the necessary documents to run the business are current and in use. If small business owners were not already overwhelmed, delving into topics that are unfamiliar to you can certainly make you feel that way. In this multi-part series, we’ll take a look at internal procedures and the documents you’ll need to protect and run your business, while meeting a variety of requirements.

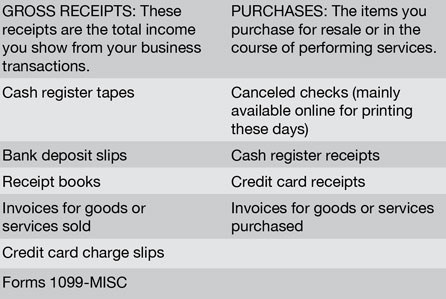

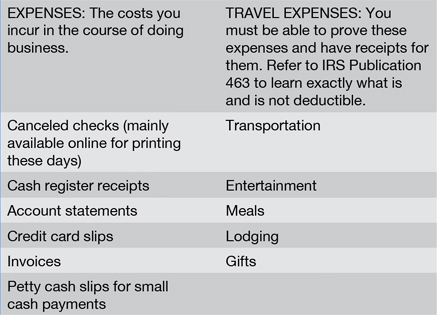

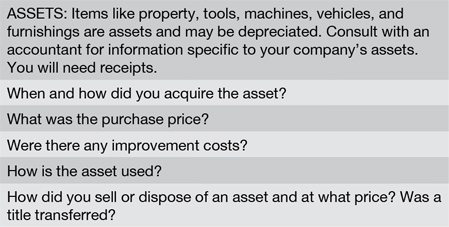

Everyone has heard of the Internal Revenue Service (IRS). The IRS has been in our lives for years, and it should come as no surprise that running a small business will mean meeting certain guidelines regarding recordkeeping. It’s important to keep the documents outlined by the IRS since they are used as supporting evidence for the transactions on your books and the monies reported on your federal tax return. In the event of an audit, you may be required to produce them. The IRS requires that all records be kept for seven years.

We live in a digital age where making and keeping digital copies of your records is also recommended. Your business will need to file both federal and state returns annually, and having all of your income and expense data is critical to proper tax filing. File folders can be set up on a hard drive and denoted by year, with subfolders containing months or subjects you may file by for the year. For example, you might have monthly expense folders and have one annual folder for the banking statements, 941s, and so forth for the year. Keep your electronic files as organized as you possibly can, and make the file names such that you can easily search and retrieve the digital image of that document. This way, once you do destroy the record, you will have a copy to refer to with ease should you ever need to do so. PDFs are extremely popular for this task.

The following are what you should keep (next 3 images to the left)

The following are what you should keep (next 3 images to the left)

In order to do business, you’ll need to obtain an employer identification number (EIN). This number is required by the federal government and is also referred to as your Employer Tax ID number. This number is used when reporting tax information to both the federal government and to state agencies. It’s easy to obtain a number and can be done online without having to visit an office.

You’ll need to check with your state to see what business license requirements you may need. If you are performing residential services, you’ll also need to check to see if you are required to obtain a home improvement license of any kind. While not all states require them, many states do, and these seem to be increasing in number. Also, if you serve more than one state, you will need to investigate what may be required in order for you to do business outside of your home state. This can range from the collection of taxes to the need to obtain another home improvement license. While some states offer reciprocity, not all do. You may need to hire a resident agent in another state in order to complete the requirements if you are located elsewhere.

You’ll need to check with your state to see what business license requirements you may need. If you are performing residential services, you’ll also need to check to see if you are required to obtain a home improvement license of any kind. While not all states require them, many states do, and these seem to be increasing in number. Also, if you serve more than one state, you will need to investigate what may be required in order for you to do business outside of your home state. This can range from the collection of taxes to the need to obtain another home improvement license. While some states offer reciprocity, not all do. You may need to hire a resident agent in another state in order to complete the requirements if you are located elsewhere.

The federal government requires that employment tax records need only be kept for four years. This duration is shorter than the requirement for tax returns and receipts, but since some employment tax documents, like Form 941, may have become a part of your tax return filing, it might be easier to save the employment tax documents for seven years and not risk disposing of something you are still required to have. Keeping electronic copies of your documents alleviates some of this concern. According to the IRS’s Revenue Proclamation 97–22, you may keep a scanned copy of a receipt, provided it is an exact copy. Visit the IRS website and download the PDF of Revenue Proclamation 97–22 (www.irs.gov/pub/irs-tege/rp-97-22.pdf).

The federal government requires that employment tax records need only be kept for four years. This duration is shorter than the requirement for tax returns and receipts, but since some employment tax documents, like Form 941, may have become a part of your tax return filing, it might be easier to save the employment tax documents for seven years and not risk disposing of something you are still required to have. Keeping electronic copies of your documents alleviates some of this concern. According to the IRS’s Revenue Proclamation 97–22, you may keep a scanned copy of a receipt, provided it is an exact copy. Visit the IRS website and download the PDF of Revenue Proclamation 97–22 (www.irs.gov/pub/irs-tege/rp-97-22.pdf).

If you are considering moving your paper documents to an electronic format and are wondering if the IRS will accept them in lieu of paper, the good news is yes, but there are some conditions. You’ll need to meet the guidelines in Revenue Proclamation 97–22, but it’s not hard to do so. Any documents you scan should be exactly the same as the paper equivalent. If there are documents that you cannot scan and make a digital copy of, you would be required to keep them in paper form. You can keep the electronic copies in an index, which is searchable and requires a database, or you can simply create an electronic file system and store the files in the appropriately marked folders. Each document or receipt should be named so that if you are searching for it, it will be easy to find. Any electronic copies of documents should be backed up redundantly so that you have more than one copy in order to avoid a critical loss of data. The data must also be secure and not generally accessible to unauthorized personnel or to those outside the company. It is important to read and follow the guidelines in Revenue Proclamation 97–22 carefully since a failure to do so could result in penalties if you are audited and it becomes evident that the guidelines were not adhered to.

There are several types of taxes you will need to withhold and deposit on behalf of your employees. All employees must complete and sign Form W-4 for withholdings. This form must be updated annually, and copies should be kept in the employee’s personnel file. The form is required regardless of if an employee receives a salary or an hourly wage.

At the end of the tax year, employers must prepare W-2s. The W-2 must be mailed to all employees no later than January 31, and a copy must be sent to the Social Security Administration no later than the last day of February.

Depending on where your business is located and where your employees reside, you may be required to file taxes for one or more states on behalf of your employees as well. These taxes could also include city or local taxes, and you should consult with your accountant about what you are required to withhold.

While many smaller companies prefer to prepare their own payroll and taxes, the tasks and time it takes, along with the imposed filing deadlines can become daunting, and the laws surrounding business and payroll taxes may change annually. For these reasons, it’s recommended that you hire a certified public accountant to prepare your taxes, and that you use a payroll service to handle all aspects of your payroll filing and reporting. This also frees up your time as a small business owner, allowing you to focus your time on more pressing business matters.

Part of your responsibility as an employer is to perform due diligence when you hire a new employee and to have all new hires complete a Form I-9, available from the Department of Homeland Security. This form is available online for download as a PDF and outlines the documentation requirements for employment (www.uscis.gov/sites/default/files/document/forms/i-9-paper-version.pdf). The form shows three columns entitled List A, List B, and List C. All new hires are required by law to produce either one document from List A or two documents, one each from List B and List C. List A establishes both identity and employment authorization, while List B only establishes identity and List C only establishes employment authorization. It is important to note that new hires have only three days to provide these documents before you are required to release them from employment. Some companies require that potential hires bring the documents to their interview as a way of eliminating unqualified candidates early on in the process. The Form I-9 is not submitted to the government, but you are required to keep it on file for a minimum of three years after the date of hire or one year after the date of termination, whichever is later.

All new hires are also required to be reported to your state’s new hire registry within 20 days of their hire or rehire date. This is typically done online. Occasionally, once a new hire is reported, you may receive a notice from a tax authority stating that there are back taxes owed that must be

garnished from the employee’s paycheck. It’s also not uncommon to receive a notice to withhold child support payments. It’s important to note that any such notice must be complied with; the withholding must be taken and the payments made on behalf of the employee or minor child. Failure to do so could result in an action against your business, so compliance is extremely important.

There are workplace posters that by law must be posted in an area where employees can access and read them. Many companies post them by the time clock or in a break room, for example. While you can purchase them from companies who sell them, in many cases you can also download and print them free of charge from the state. It’s worth looking online to see if they are available for download before spending money on exactly the same information. You will also want to check annually to see if any of them have been updated, since the most current documents must be posted.

While it is true that an owner of a business can exempt himself or herself from workers’ compensation, it is the law that employers must cover their employees. Workers’ compensation insurance may be acquired through a commercial insurance carrier or through your state’s workers’ compensation insurance program.

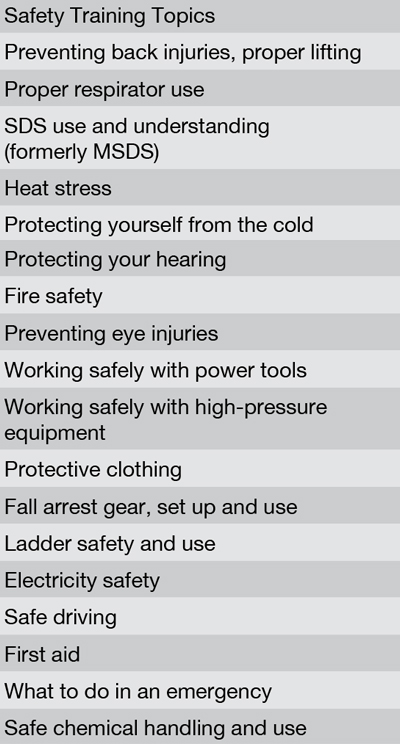

In order to help reduce the occurrence of on-the-job injuries and promote a safe workplace, tailgate trainings on safe practices should become a regular part of your workplace routine. OSHA has a number of free safety training guides online, and there are other sources as well. Many of the documents out there are available in both English and Spanish and should be presented to your employees in their primary language. After each topic has been reviewed and discussed, it’s a good idea to have the employees sign and date the training sheet, which should become a part of their employee file. A copy should also be given to each employee as reference material, or perhaps a

In order to help reduce the occurrence of on-the-job injuries and promote a safe workplace, tailgate trainings on safe practices should become a regular part of your workplace routine. OSHA has a number of free safety training guides online, and there are other sources as well. Many of the documents out there are available in both English and Spanish and should be presented to your employees in their primary language. After each topic has been reviewed and discussed, it’s a good idea to have the employees sign and date the training sheet, which should become a part of their employee file. A copy should also be given to each employee as reference material, or perhaps a

safety book could be placed in each truck and in the shop or break room. Some of the topics to consider for safety training are as follows (image to the left).

This list is by no means all of the topics, but it should give you a good idea of the opportunities for creating and maintaining a safe work environment that you have before you. Visit OSHA.Gov to download free information on a variety of safety topics in both English and Spanish and to learn the latest about OSHA’s requirements. It is also worth noting that in addition to the manager filling out an injury report documenting any injury, any employee injured on the job should be tested for drug use.

OSHA has revised its recordkeeping rule to include two important changes. Dr. David Michaels, formerly the Assistant Secretary of Labor for Occupational Safety and Health from 2009–2017, stated, “OSHA will now receive crucial reports of fatalities and severe work-related injuries and illnesses that will significantly enhance the agency’s ability to target our resources to save lives and prevent further injury and illness. This new data will enable the agency to identify the workplaces where workers are at the greatest risk and target our compliance assistance and enforcement resources accordingly.” Employers with ten or fewer employees continue to retain exemption under the new rule, regardless of the industry they serve. However, recordkeeping remains crucial as this could change in the future. It’s important to document any injury and to retain those documents regardless as a matter of thorough recordkeeping. Additional information on this new rule may be found on OSHA.Gov.